KFH Offers Banking Services Powered by Modern Technology

In line with its commitment to meeting customer needs and keeping pace with the latest technologies, Kuwait Finance House (KFH) offers through its smart branches leading banking services that are convenient, secure, and seamless, ensuring the highest standards of excellence.

These efforts affirm KFH’s leadership in digital transformation and innovation, enabling the Bank to offer digital financial and banking solutions that add value to customer experience.

KFH is keen to strengthen the presence of its smart branches, which are currently spreading across Kuwait. Customers can find these branches in The Avenues and the co-op societies of Ishbiliya, Jabriya, Mangaf, Sabah Al-Ahmad, Al-Salam, and Abu Fatira. The branches are also located in Shuwaikh KFH Auto Showroom, Al-Khiran Mall branch, as well as Abdullah Al-Salem .

Thanks to their success and ease of access to various banking transactions, KFH aims to increase the number of its smart branches to meet the needs of customers in most areas of Kuwait.

Additionally, KFH continues to strengthen its service delivery channels through smart branches, KFHOnline application, social media platforms, as well as through robotic and AI technologies, among many other innovative alternatives to traditional banking channels.

Through its network of electronic branches across Kuwait, customers are able to access a wide range of interactive banking services such as Murabaha transactions, requesting credit and prepaid cards, updating personal data and mobile number, activating cards, instant cheque book printing, instant card issuance, receiving 10 gram gold bullions, opening accounts, buying and selling gold, and cardless cash withdrawals via mobile using a QR code, civil ID, or mobile number, among other fast and secure financing and banking transactions.

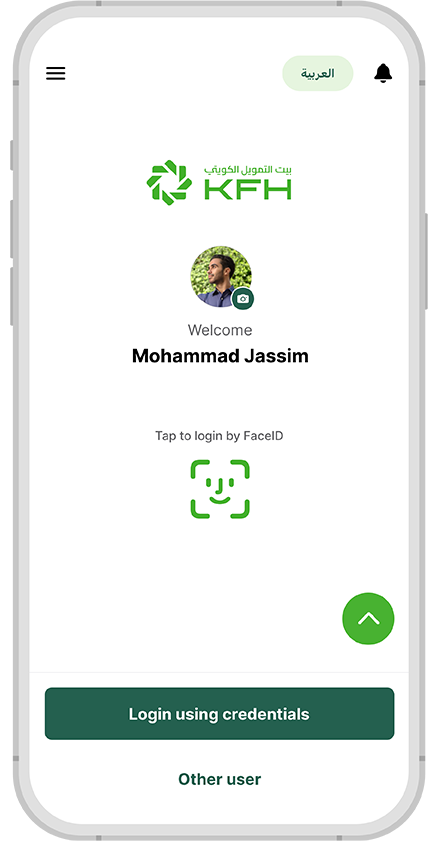

Affirming its leadership in digital innovation, KFH comprehensively updated its ATMs and KFHOnline mobile app, featuring a sleek modern design and smart services. Currently, KFHOnline provides over 200 banking services.

The e-banking transactions also include instant virtual prepaid card issuance, checking the PINs of the credit and debit cards, opening an additional bank account online without having to visit the branch, temporarily suspending cards, opening deposits, adding beneficiaries, balance inquiry, requesting financing, checking the financing obligations and the number of installments, reviewing investment plans, receiving account balances and deposits summary, in addition to managing children’s accounts through Baiti account, in addition to many other online e-services.

It is worth noting that the fully automated smart branches which operate 24/7 reflect the significant progress in the retail banking industry amid the growing users’ reliance on technology for quick and highly efficient banking services.

Germany

Germany Malaysia

Malaysia Turkey

Turkey Egypt

Egypt UK

UK Kingdom of Bahrain

Kingdom of Bahrain