KFH Offers Advanced Banking Experience through KFH Academy

Kuwait Finance House (KFH) has launched the new edition of its KFH Academy program, designed to introduce university students and recent graduates to the fundamentals and functions of various sectors and departments within KFH. This initiative is part of KFH’s commitment to social responsibility, training excellence, youth development, and national talents empowerment.

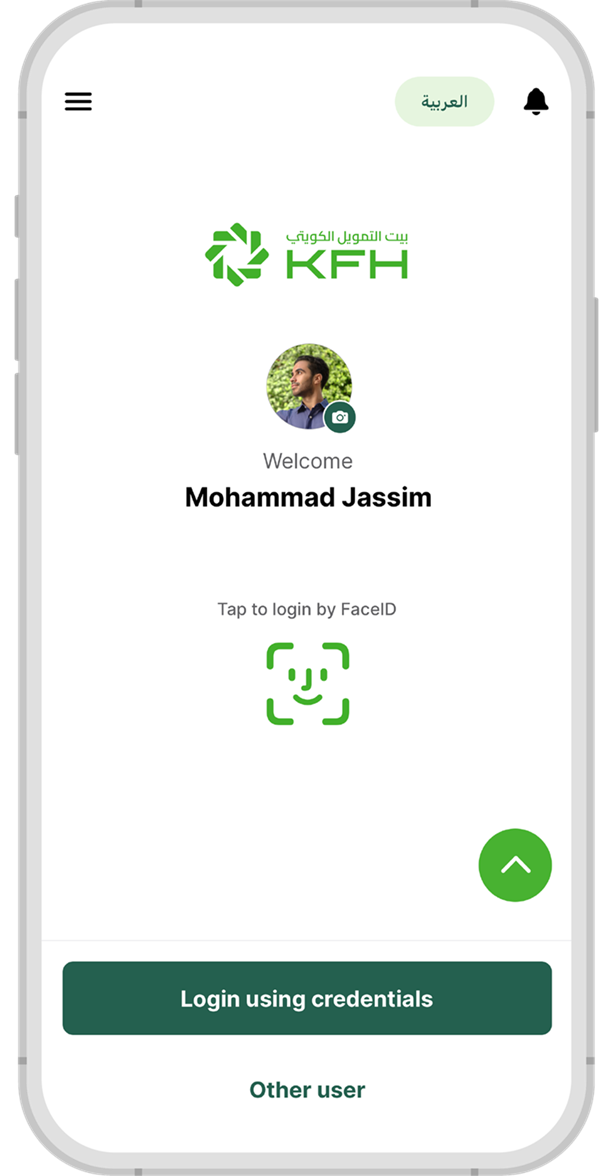

KFH Academy offers students practical training within a professional banking environment at the largest bank in Kuwait by market cap. The program includes diverse learning areas such as public relations (PR) and media, general services, digital transformation and innovation. It enables students and recent graduates to gain a foundational understanding across these areas using the latest methods and highest standards of training quality, making the most of their summer break.

A total of 20 trainees were selected to join the academy after successfully passing all stages of assessment and evaluation.

The launch event of KFH Academy took place at the Bank headquarters with the attendance of Head of Public Relations and Media at KFH Group, Yousef Abdullah Al-Ruwaieh, Deputy General Manager Digital Transformation and Innovation, Eng. Tareq Al-Ajeel, Executive Manager General Services, Ayman Altabtabaei, Senior Manager PR and Event Management, Fahad AlSaad, and Manager Talent Acquisition, Nawaf Almishri, alongside a number of officials from the Bank.

Eng. Tareq Al-Ajeel

KFH Deputy General Manager Digital Transformation and Innovation, Eng. Tareq Al-Ajeel said that KFH Academy affirms the Bank’s commitment to preparing a technical and leadership-ready generation by offering students direct interaction with department teams and engaging them in digital initiatives aligned with KFH’s aspirations.

Al-Ajeel emphasized that hosting students through this program is crucial for building their innovation and digital transformation skills, laying the groundwork for their professional futures.

Ayman Altabtabaei

KFH Executive Manager General Services, Ayman Altabtabaei, said that the program offers participating students comprehensive experience, combining theoretical content supported by facts and practical training through site visits to KFH major projects, such as the reconstruction of the damaged area in Al Mubarakiya, in addition to the maintenance of the buildings network of KFH.

He emphasized KFH’s dedication to supporting initiatives that develop national talents, particularly among the youth, pointing out that KFH Academy provides a unique opportunity for students to explore various career paths.

Altabtabaei explained that the General Services’ participation involves three key departments: Projects, Maintenance, and Service Contracts, ensuring added value for both students and the program.

Fahad AlSaad

Meanwhile, KFH Senior Manager PR and Event Management, Fahad AlSaad, said that KFH is pleased to welcome students seeking to enhance their skills and gain practical experience in areas of public relations, media, engineering projects, digital transformation and innovation. He noted that KFH is the first bank to introduce dedicated training for engineering students, catering to a wide range of academic disciplines.

AlSaad noted the program will feature visits to institutions such as Kuwait Times and CODED Academy. Additionally, as part of KFH's "Keep it Green" environmental campaign, a specialized training course will be conducted with Kuwaiti environmental influencer, Alzainah Albabtain.

He also explained: "KFH Academy will teach students about KFH's products, services, and Islamic banking. They'll gain crucial knowledge on saving and investing through sessions with KFH Capital, a KFH Group subsidiary, which will also cover the stock market and trading."

Nawaf Almishri

Manager Talent Acquisition at KFH, Nawaf Almishri said that KFH Academy runs for 4 weeks and is designed to prepare students for the job market after graduation. The program includes lectures, seminars, extensive workshops, and field visits to various official bodies. It enriches the trainees’ understanding of how public institutions operate, especially financial institutions, enhancing the program’s practical, comprehensive, and diversified nature.

PR Academy by KFH Program

It is worth noting that last year, KFH launched its inaugural PR Academy program. Designed to educate undergraduate students and recent graduates, the program focused on the foundational principles of public relations and media, and their practical application within KFH departments. The program successfully trained students in public relations and media, culminating in presentations of their projects. Participants praised the program's creative ideas, attention to detail, acquired knowledge, and beneficial workshops.

Germany

Germany Malaysia

Malaysia Turkey

Turkey Egypt

Egypt UK

UK Kingdom of Bahrain

Kingdom of Bahrain